At CAS.ai, we’ve found the opposite is true. January stops being a problem when you treat it as a predictable seasonal phase and manage it proactively, rather than scrambling to fix things after the fact.

This January, CAS.ai’s publishing team delivered results comparable to our peak Black Friday weeks—still widely regarded as the most profitable stretch of the year.

Facts & figures: January at Black Friday level

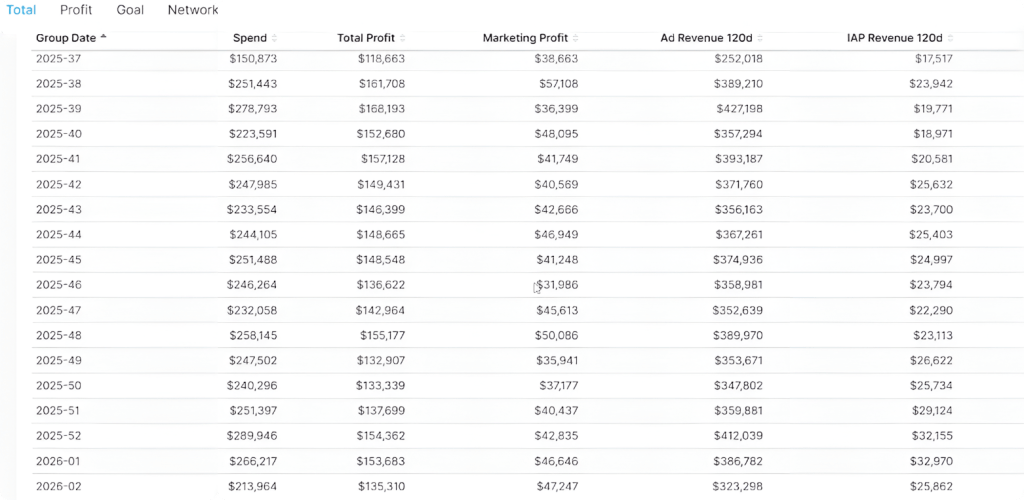

A look at weekly Total Profit (marketing profit) makes the point clear:

- In past years, our best Black Friday and pre-New Year weeks typically delivered $130–140K profit per week.

- The final “holiday” week reached $154K, one of the strongest weekly results across the year.

- After the New Year break—when the market usually softens—CAS.ai held performance at around $135K per week, fully in line with strong November and December levels.

Weekly UA performance across December 2025 and early January 2026, highlighting how CAS.ai sustained profit through the post-holiday market shift.

In practical terms, January landed at roughly 10–12% below the absolute Black Friday peak. For the market overall, a 30–50% drop in the same period is far more common.

That’s why this wasn’t just “steady” January performance—it was a structurally strong month.

What we did differently: the publishing team’s role

The biggest lever was our publishing-led approach and the way we use predictive models in User Acquisition.

As CAS.ai CMO Zoryana Omelchuk points out, the market’s most expensive mistake is cutting bids too late—after teams can already see eCPM falling and performance slipping.

took a different approach:

- We began lowering bids early, 28–30 December, through controlled, step-by-step adjustments.

- We made a meaningful cut on 31 December, before the market entered its sharp CPM decline.

- CPI and ROAS moves weren’t driven by “yesterday’s numbers”, but by calendar- and seasonality-based predictions.

The outcome:

- Spend didn’t balloon 1.5–2x, which is a common pattern between 1–5 January.

- Algorithms kept their learning intact.

- Predicted profit stayed on target.

Why the market loses money in January

The mechanics behind the January dip are well understood:

- Large advertisers hit budget limits.

- CPM falls quickly.

- UA systems don’t adapt fast enough.

- Yesterday’s bids become overpriced in the new market reality.

Most teams respond reactively, cutting bids 3–5 business days later. By that point, some of the budget has already been burned and learning models have deteriorated.

CAS.ai chose a different route—and moved ahead of the market.

January is decided in advance, not in the first working week

One of the key messages from our publishing team is simple:

You can’t analyse January in isolation from the calendar.

Seasonality is remarkably predictable:

- End of quarter

- Black Friday

- Christmas

- New Year

- The first half of January

All of these points are known in advance. And if you plan for them—by:

- lowering CPM targets,

- adjusting ROAS,

- managing bidding in staged steps,

—then January stops being an “unknown risk”.

What really drives January’s financial outcome

Use the calendar. Work with predictions. Make the decisions before the market forces your hand.

Do that, and January stops being a problem—and becomes just another month you can win.