August–September 2025 was a stress test for mobile developers. Across the industry, core monetization metrics dropped unexpectedly—especially retention and impressions per daily active user (imp/DAU).

Two overlapping triggers made the situation worse:

-

Google’s API 35 deadline (required by September 1).

-

An AdMob SDK issue on Android 15+: the close (“X”) button on interstitials was rendered outside the ad’s visible area, effectively turning interstitials into non-skippable ads.

At first glance, these looked like sufficient explanations for the sharp decline. A deeper investigation showed the picture was more complex.

The AdMob SDK Issue

Yes, the bug was real and it harmed user experience. Any interstitial effectively became non-skippable, which irritated players and risked churn.

Why this is critical: users can’t close the ad → frustration grows → churn increases → your app’s value erodes.

At CAS.ai, the issue was mitigated starting with SDK version 4.2.1. However, our data indicated that AdMob alone did not explain the imp/DAU drop in early August.

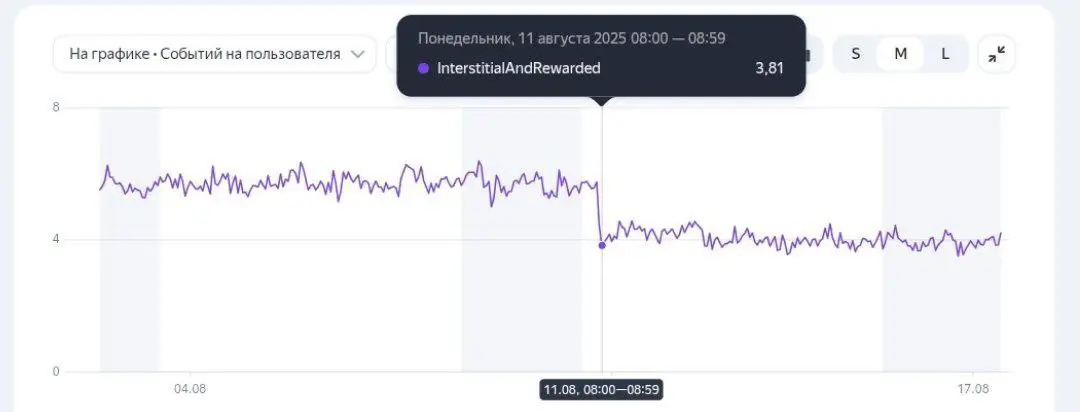

The imp/DAU Slide We Observed

On a partner’s chart we saw a sharp decline on August 11. Initially it could be dismissed as noise, but metrics did not rebound after several days—pointing to a systemic problem.

We ruled out internal causes: AB tests, ad timing changes, mediation tests, or new network integrations. The root cause lay elsewhere.

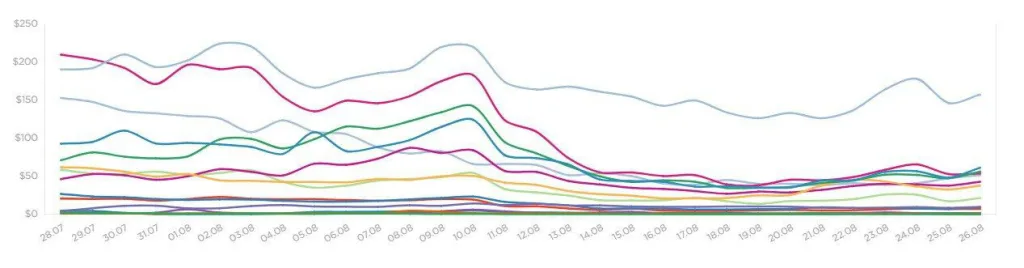

Revenue Mix: What Changed Across Networks

Classic mediation typically leans on a “top ten” set of networks: AdMob, AppLovin, DT Exchange, Google Ad Manager, ironSource, Meta, Mintegral, Pangle, Unity Ads, Vungle/Liftoff.

In August we saw declines across most networks—except AppLovin. On partner data, the top line (AppLovin) held steady while others dropped. That was our signal: a material change occurred in AppLovin’s delivery logic.

What Did AppLovin Change?

After reviewing creatives and flows, we found AppLovin modified its ad experience, notably for interstitials:

Before: ~5s video + 3s end card.

Now: 7s + 5s + 3s = minimum ~15s.

The key shift: the Skip button is replaced by a Google Play action that takes users directly to the store (instead of to the end card).

This boosts AppLovin’s own performance but disrupts the familiar user journey and alters cross-network balance within mediation.

Market-Level Effects We’re Seeing

-

Longer ad interaction time.

-

Higher conversion to store.

-

Performance pressure on other networks.

-

Developer-side impact: retention declines, imp/DAU drops, and revenue share shifts toward AppLovin.

What Developers Can Do Now

Option 1 — Negotiate with AppLovin

Ask to restore the previous flow or enable lighter settings.

If negotiations fail:

Option 2 — Temporarily remove AppLovin from mediation

-

In ironSource and AdMob: disable manually.

-

In CAS.ai: contact support to switch it off quickly and cleanly.

Option 3 — Change your mediator

If your current setup doesn’t let you control flow and policies with sufficient granularity, consider a mediator that does.

Takeaways

August–September 2025 exposed how fragile the monetization stack can be.

-

Google introduced chaos with an AdMob SDK bug on Android 15+.

-

AppLovin changed its delivery format, rebalancing outcomes across networks.

Developers should respond proactively:

-

Tune your mediation,

-

Open a dialogue with networks,

-

Test alternatives and document impact.

At CAS.ai, our goal is to help the community surface issues early, share fixes, and keep your revenue stable. If you need a hand reproducing, measuring, or mitigating the patterns described above, we’re here to help.

![]()